Roth IRA Contribution Limits

Understanding Contribution Limits and Opening Your Retirement Accoun Navigating Roth IRAs in 2024

Navigating Your Retirement Savings: Knowing the Limits for Retirement Account Contributions in 2024.

When do you retire, have you calculated your basic salary contribution for retirement?

Planning for retirement involves understanding the ins and outs of different retirement accounts, such as traditional and Roth Individual Retirement Accounts (IRAs).

As we dive into 2024, it’s crucial to be aware of the updated contribution and income limits for Roth IRAs.

In this article, we’ll explore the changes, providing insights into maximizing your retirement savings while adhering to the regulatory guidelines.

READ ALSO : Comperhensive guide to the benefits

Understanding Roth IRA Contribution Limits

The Internal Revenue Service (IRS) recently announced changes to the contribution limits for Roth IRAs in 2024. These limits affect both individuals under the age of 50 and those aged 50 and older. The table below illustrates the adjustments:

Year Under Age 50 Age 50 and Older

- 2023 $6,500 $7,500

- 2024 $7,000 $8,000

These limits are cumulative across all traditional and Roth IRAs. It’s important to note that contributing to multiple accounts won’t allow you to surpass these limits.

For instance, if you’re 50 years old and contribute $3,500 to a traditional IRA, your Roth IRA contributions for the same year cannot exceed $4,500.

Consequences of Exceeding Contribution Limits

Contributors exceeding the established limits must withdraw the excess funds, along with any earned income on those funds, before the tax deadline.

Failure to comply with this rule may result in a penalty, with excessive contributions being taxed at 6% per year for each year the money remains in the account.

The IRA Contribution Deadline

To make the most of your contributions, it’s crucial to be aware of the IRA contribution deadline, which aligns with the tax return filing deadline. For example, Roth IRA contributions for the year 2023 can be made until April 15, 2024.

This flexibility is particularly beneficial for individuals uncertain about their annual earnings and eligibility.

READ : Get to know the types of long-term and short-term investment

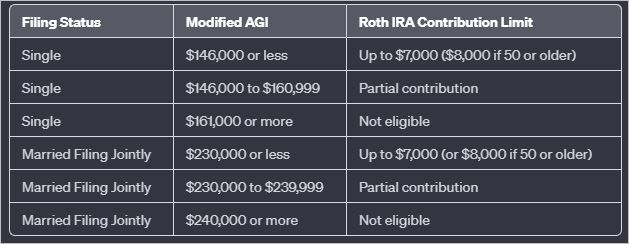

Roth IRA Income Limits and Calculations

While contribution limits apply universally, income limits are specific to Roth IRAs. The modified adjusted gross income (MAGI) determines eligibility and contribution limits based on filing status. The table below outlines the MAGI limits for 2024:

- Start with your MAGI.

- Subtract $146,000 or $230,000 based on filing status.

- Divide by $15,000 or $10,000, respectively.

- Multiply by $7,000 or $8,000, depending on age.

- Subtract the result from $7,000 or $8,000.

- For example, a 50-year-old single filer with a MAGI of $151,000 in 2024 would follow these steps to determine their contribution limit.

Conclusion:

Navigating the intricacies of retirement account contributions involves staying informed about annual changes and understanding how to optimize your savings.

As we enter 2024, the increased Roth IRA contribution limits present new opportunities for savvy investors.

By knowing the limits for retirement account contributions and being mindful of income thresholds, you can make informed decisions to secure your financial future.

read other interesting articles on Google News